5. Levies for military campaigns and canal construction

Horsemen for Military Campaigns

At the end of the treatise, al-Nābulusī records a levy of four hundred horsemen to be provided by the Arab tribesmen of the villages of the Fayyum as auxiliary forces in the event of a royal campaign. The total of four hundred riders is divided equally between the Banū Kilāb and the Banū ʿAjlān, each required to provide two hundred horsemen.

Giza Dam Levy

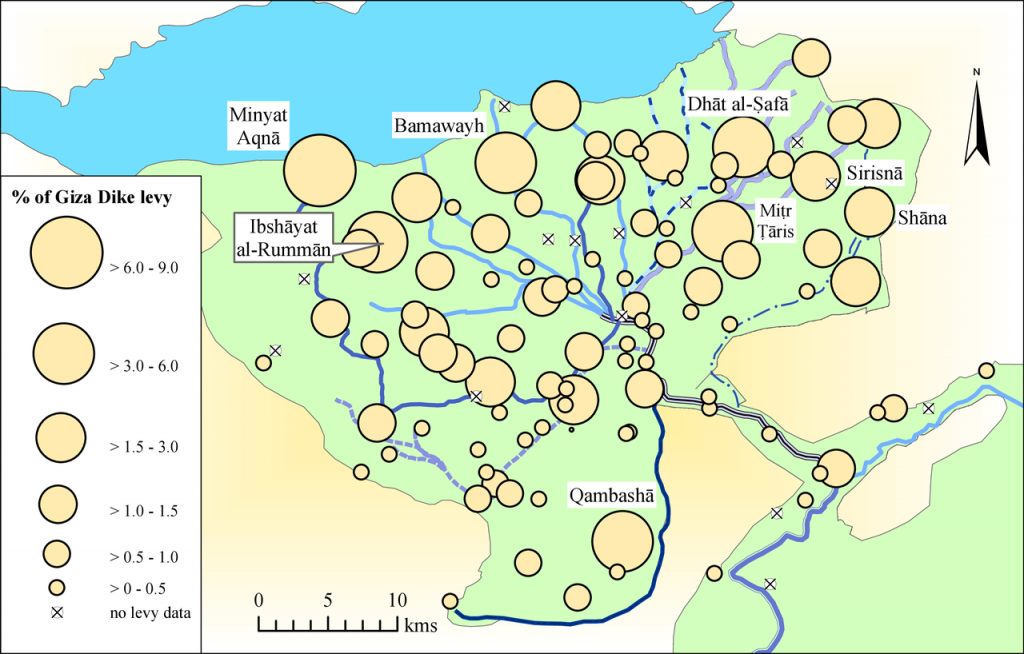

Al-Nābulusī reproduces a royal decree, dated to the end of 642 (May 1245), ordering the province to raise one hundred dredging units (jurrāfa, pl. jarārīf) for the construction of the dam of al-Muḥraqa in the nearby province of Giza.[1] Since most villages were ordered to pay a fraction of a jurrāfa unit, this levy must have been paid in cash or in labour, not in actual dredging equipment.

According to Ayyubid practice, when a province required a new dam, a levy was divided between the villages of those provinces that would stand to benefit from the dam. Each village was set an amount according to its capabilities at the time and according to the extent of its cultivation.[2] The villages had the option of commuting this levy to cash, at a rate of 10 dinars per unit.[3]

MAP: Relative village size (based on the Giza Dam Levy)

[1] On large irrigation projects by the central government, see Sato, State and Rural Society, pp. 227–33.

[2] Ibn Mammātī, Kitāb qawānīn al-dawāwīn, ed. by ʿAṭiya, pp. 342–44. A later account by al-Qalqashandī describes an annual process of maintenance of royal dikes, led by an amir appointed as the Superintendent of Dikes (kāshif al-jusūr) at a given province, and supported by a tax levied in dredging units (jarārīf), ploughs and beasts of burden; al-Qalqashandī, Ṣubḥ, iii, 448–49. See also Rabie, The Financial System, p. 115; Nicolas Michel, ‘Travaux aux digues dans la vallée du Nil aux époques papyrologique et ottomane: une comparaison’, Cahier de recherches de l’institut de papyrologie et d’égyptologie de Lille, 25 (2005), 253–76.

[3] Al-Maqrīzī, possibly on the basis of Ibn Mammātī, confirms that each village had to pay a certain number of units (qiṭāʿ) towards to the royal dikes levy (muqarrar al-jusūr). The payment was commuted to cash at a rate of 10 dinars per unit; al- Maqrīzī, Kitāb al-mawāʿiẓ, ed. by Sayyid, i, 288, 297. See also Cooper, ‘Ibn Mammati’s Rules’, pp. 313–15, on special taxes for the construction of dams in the provinces of al-Gharbiyya and al-Sharqiyya, called al-rusūm al-muwaẓẓafa.